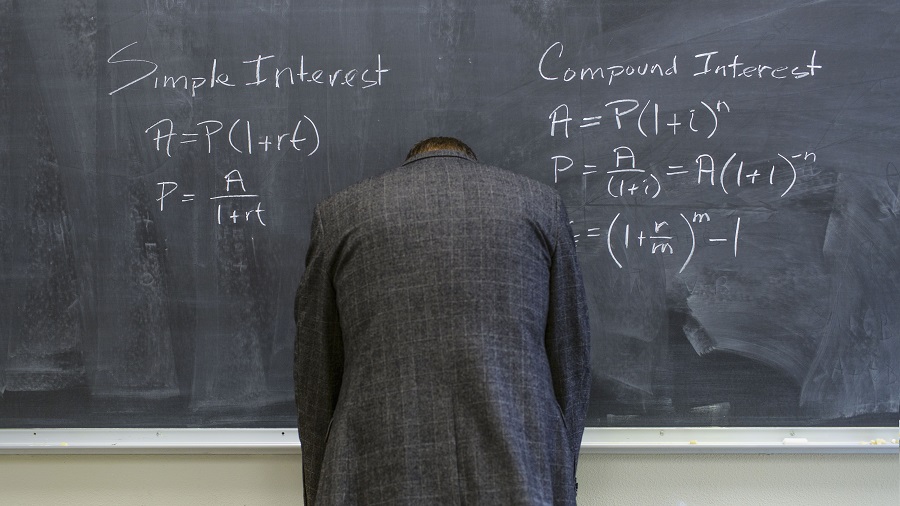

A lot of you must have heard the term ‘The magic of compounding interest.’ You might want to know what compound interest is, and how can it help you build a robust financial portfolio? Compound interest is accumulated interest gained on the principal amount. In simple words, compound interest is an amount calculated using the principal and the interest earned over time.

When compound interest is applied to your investment, your earnings grow significantly. This happens because you are not just gaining interest on the principal amount you had invested, but also on the interest accumulated in the period.

For example, you open a fixed deposit account with a maturity period of 10 years. You invest Rs. 1 lakh and the interest rate in the beginning year is 10%. At the end of the year, the interest earned will be Rs. 10,000.

In the following year, based on the same interest rate, the principal amount will be Rs. 1,10,000. The upcoming term’s principal is calculated by adding the initial principal and interest earned. The principal amount will only keep on growing over the years. Hence, you make more profit without spending extra money.

Here are some essential things for you to consider about compound interest:

- The more you stay invested, the more you gain

With compound interest, the longer you stay invested, you get higher benefits. The interest amount will get higher every term, which in turn will increase the total payout. This cycle will help your finances grow exponentially. Hence, it is recommended to invest as early as possible and stay invested for as long as you can.

- Compounding frequencies matter

Simply put, the shorter your compounding frequency for your interest is, the higher the profits. You will earn more if the amount is compounded quarterly, compared to an investment where the amount is compounded annually.

To get a better understanding of how the compound interest works, you can try using the online compound interest calculator. The tool will help you understand how much interest you can earn on an investment. It will also give you a broader understanding of how your investment can grow exponentially based on the rate of interest, the investment, and the maturity period. The calculator can help you get on a track to reach your financial target. However, there are some factors that a compound interest calculator takes into account.

The investments, which generate returns based on compounding, will help you reap benefits in the future. Though it might seem that you are not making enough money in the initial years, stay invested for a longer period, and you will see it grow exponentially. For example, you can double your investment in 12 years at an interest rate of 6%, and that too without any extra amount. To fully explore the potential of compound interest, invest early and stay invested for a longer time.